Blog

Novacura at Infoteam Days 2024 in Norway

This April, Novacura was excited to showcase our innovative low-code platform at Infoteam Days 2024, held at the Clarion Hotel & Congress Oslo Airport. As […]

Novacura at the M3 User Association UK Conference 2024

We are excited to recount that Novacura was not just a participant but also a presenter at the recent M3 User Association UK Conference 2024, held on […]

Novacura at the M3 User Group Denmark Annual Meeting 2024

Novacura was delighted to participate in the M3 User Group Denmark Annual Meeting, held on April 17-18, 2024, at Hotel Svendborg. This year’s meeting was […]

IFS Customer Day Finland 2024: Preparing for Evergreen with Novacura

The IFS Asiakaspäivä 2024 took place in Helsinki bringing together key players in the local IFS ecosystem. Östen Westman, representing Novacura, delivered an insightful presentation titled […]

Tomorrow Logistics Conference, Poznan - 'Just in Sequence' Strategy Case Study

Introduction Novacura participated for the second consecutive year in one of Poland’s largest logistics and manufacturing events – Tomorrow Logistics Conference in Poznan (March 13th). […]

IFS Cloud upgrade - ultimate guide

Most ERP users who are not already in the Cloud are likely considering migration. We’ve consulted our top experts to understand why upgrading is worth […]

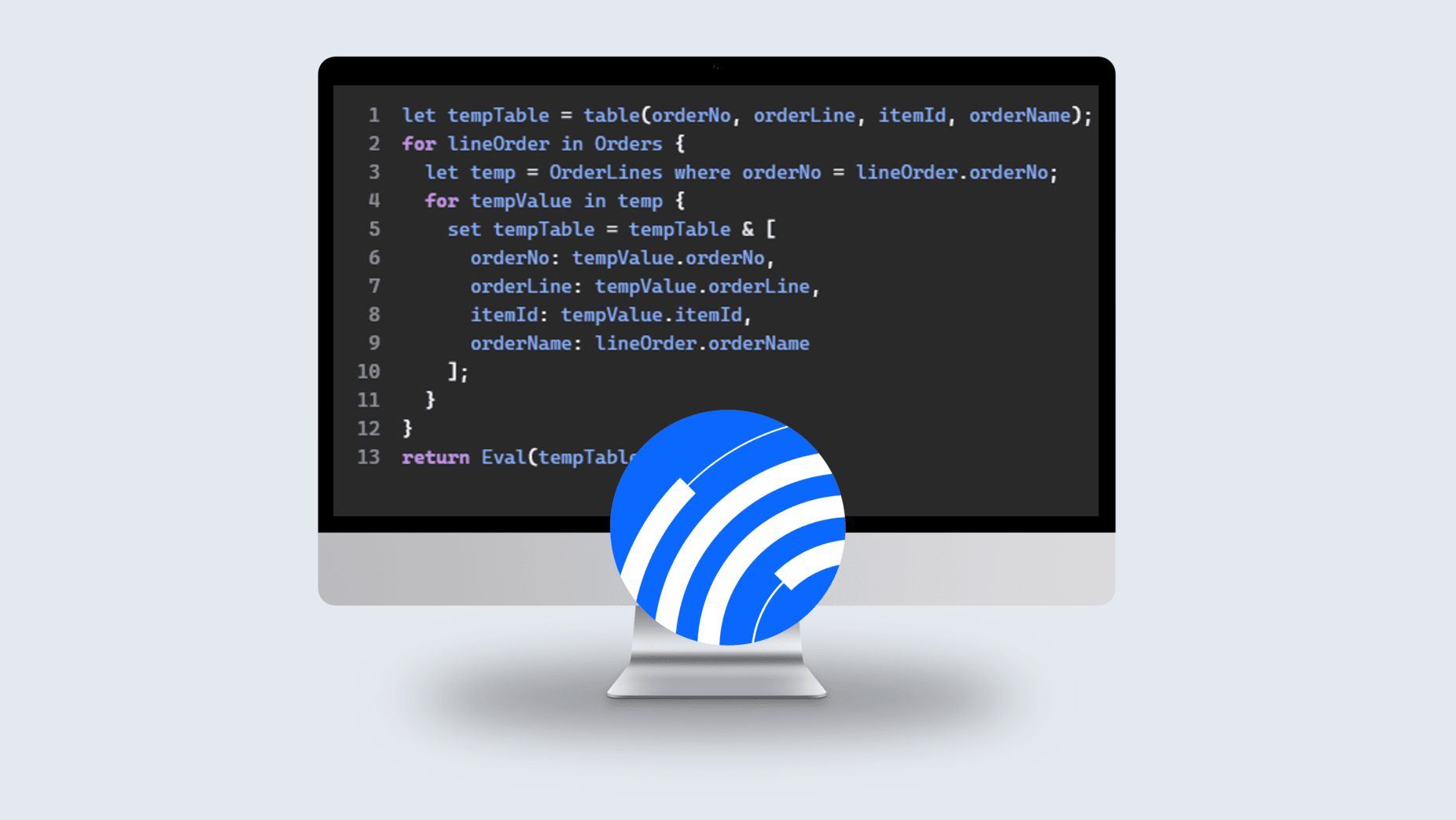

Novacura Flow 6.15 – A significant performance improvement that you must see!

INTRODUCTION Novacura Flow is a low-code platform that expands ERP systems and allows customers to build their own ERP applications. It offers deep ERP integration and […]

Implementing IFS Cloud at Söderenergi - leading Swedish power heating supplier

Introduction Söderenergi is a leading energy company, producing district heating and electricity in the Stockholm region, and contributing to the ongoing green transition. We are delighted […]

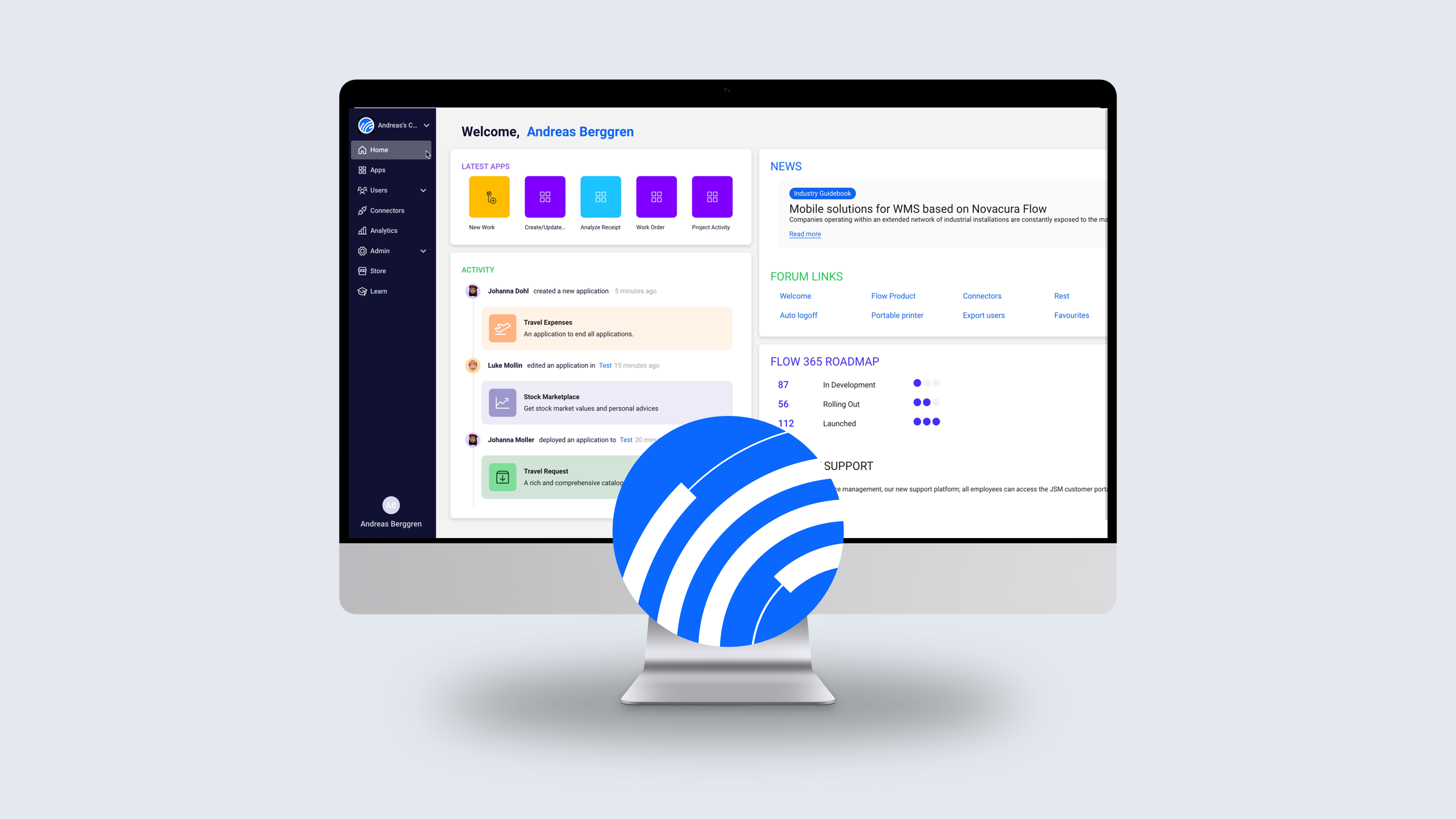

Novacura Flow Connect successfully launched for the first company!

Novacura Flow is bridging gaps between various ERPs and end-user needs since 2009. Since then we have been assisting more than 150 thousand users and […]

Nordic Paper's IFS Cloud Journey: at IFS User Group Day, Stockholm

INTRODUCTION Novacura, as an active member of the IFS Scandinavian User Group, lead a seminary during the latest IFS User Group Day on November 22, 2023, […]

The DIAG Congress 2023 - Novacura among Premium Sponsors of one of the biggest IFS focused event in DACH region

IFS Cloud upgrade – how to reduce risks with low-code tools! The DIAG Congress, organized on November 16th and 17th by the German-speaking IFS User […]

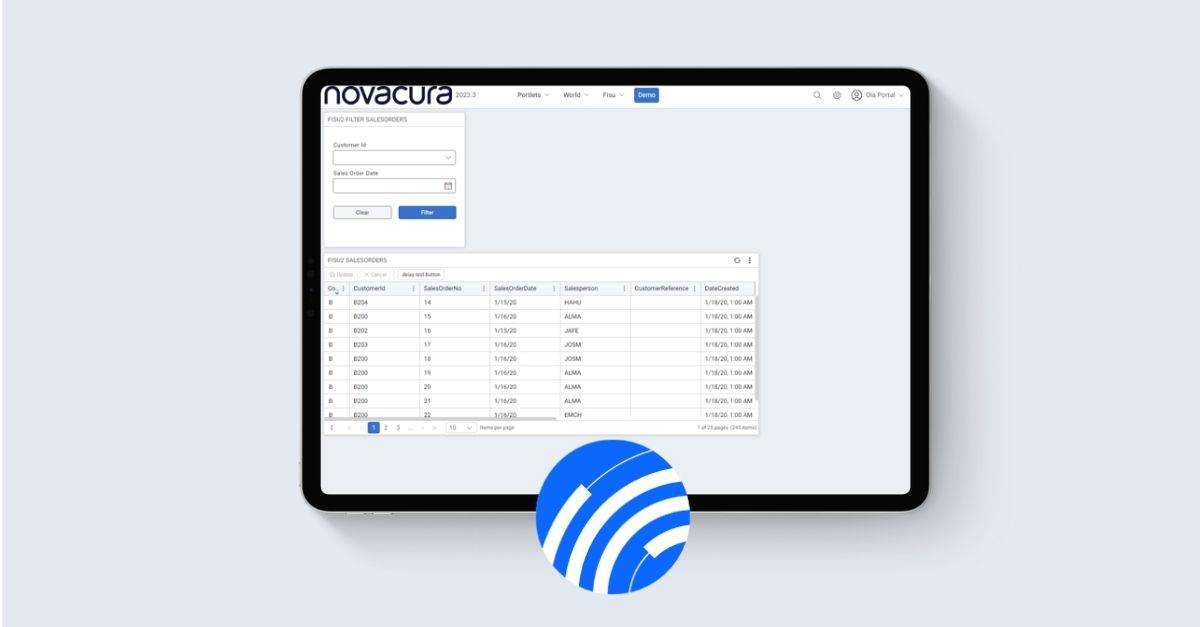

Novacura Flow 6.15 and New Portal - RELEASE!

Recently, we achieved significant milestones with the release of our latest version, Flow v.6.15 and a new version of the Flow Portal 2023.3. Novacura Flow version 6.15 puts major emphasis on mobile scanning functions. Automatic forwarding simplifies user interaction with their workflows and processes. This version represents a significant step towards user-centered development